Trustcapital-realestate

What do we look for?

Investors seeking out a value-add real estate deal will want to look for the following: below market rents (usually 20-30% loss to lease), low occupancy rates, low economic occupancy rates (i.e., the number of people paying rent), physically outdated property (exterior and interior), and under or mismanagement.

There are three categories of value-add properties based on how much work or capital investment needs to go into the property to generate higher values.

On a mission to unlock the potential of real estate investing. We are rebuilding the real estate investment experience, making buying, earning income, and selling income-producing real estate instant, low cost, and enjoyable.

Trustcapital-realestate

-

-

Light value-add

This generally entails addressing any deferred maintenance and inexpensive improvements, such as refreshing the units with new paint, carpet, lighting, plumbing fixtures, and USB electrical outlets.

Some exterior improvements may include upgraded landscaping, new paint, re-striping the parking lot, or renovating the amenities. Renovating amenities is a great strategy, as it can be done without losing revenue or disrupting tenants.

Light value-add improvements will make the property look better but require limited capital investment.

Medium value-add

Medium value-add improvements include a range of the light value-add improvements noted above but may also include more expensive upgrades like fully renovating bathrooms and kitchens and making a few capital improvements like replacing HVAC systems or a roof.

Many successful investors find that medium value-add properties provide the best bang for their buck for their commercial real estate purchases.

Heavy value-add

A heavy value-add strategy contains everything from a light and medium value-add strategy but may also include gutting the property to the studs.

The owner may reconfigure walls, add or remove a building, and invest in expensive new amenities such as an in-ground pool or community center.

When assessing value-add investments in real estate syndications (which is the most common way investors can access value-add strategies), most investment materials will outline how the operator plans to add value to the investment – which is typically a mix of operational enhancements.

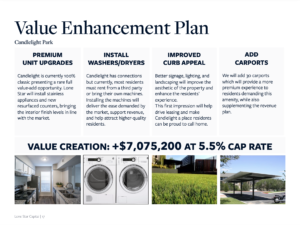

- Above is an example of a value add enhancement plan from a real estate syndication

-

Upside Yield = Increased NOI / (Acquisition Price + Capital Investment)

= $100,000 / ($1,000,000 + $200,000) = 8.3%

Trustcapital-realestate

The reason this numbers is different is due to the higher return on the capital improvements – generating $50,000 of NOI from just $200,000 of investment.

Value-add return

= $50,000 / $200,000 = 25%Trustcapital-realestate

This example above demonstrates how Yield to Cost takes both the current and future potential yields into account, providing a more holistic view of the potential return on investment. This is why often Value-Add investments can trade at lower capitalization rates, as buyers know that the yield of the asset can be improved through a value-add strategy.

Lastly, one aspect that the Yield to Cost fails to consider is the timeline. Specifically, it does not account for the time required to achieve the projected yield.

This can be a significant oversight as the time to get to the Yield to Cost might be longer than anticipated, which could affect the overall return on investment. Delays in renovations, permit approval, or tenant turnovers can prolong the timeline, thus affecting the investment’s ultimate profitability.

How to find value-add real estate properties

Value-add real estate can be found in virtually every community.

Here are some ways to identify value-add assets in your target geographies:

- Real estate agents

- Real estate investment groups

- Online listings

- Crowdfunding platforms

Real estate agents

Real estate agents have their ear to the ground and are an invaluable resource when looking for off-market real estate deals.

When assessing whether a property has good value-add potential, an agent can also help compare properties to other local comps. These comps will help identify what improvements (physical or otherwise) are needed to bring the property up to market rate.

Real estate investment groups

There are many formal and informal real estate investment groups. These groups are a great way to network with other successful real estate investors and learn about available value add investments.

Many real estate investors will share their best execution tips and techniques with their peers through groups like these.

Online listings

Many online platforms, like CoStar and LoopNet, can be used to find value add real estate for sale. Other platforms, like Reonomy, allow users to search for properties based on certain characteristics like age and most recent sale.

For example, someone might search for properties at least 30 years old that have not been sold in the past 10-15 years. This could signal that the property is ready for value-add improvements and may be worth an off-line conversation with the owner to gauge their interest in selling.

Real estate syndications

Real estate crowdfunding platforms are a great way to search for value-add real estate deals from syndicators around the country. Sponsors use these sites to connect with debt and equity investors who want to own a fractional share of real estate deals.

One of the primary benefits of investing in value-add real estate using a crowdfunding platform is that the featured deals are managed by an experienced sponsor.

Investing alongside a sponsor (vs. directly purchasing an investment property) allows the investor to earn passive income without the day-to-day responsibility of the business plan execution.

HoneyBricks, for example, works with leading sponsors and features hand-selected and professionally managed US real estate for as little as $1,000.

The bottom line

Value-add real estate can be an excellent investment strategy for achieving higher returns with additional risk. This is especially true as land, material, and labor costs continue to climb.

Oftentimes, the acquisition and improvement costs still cost much less than it would cost to build a property from the ground up. It’s not an easy strategy (especially compared to buying an already stabilized asset). The strategy is understandably predominantly executed by experienced real estate operators with successful track records of value-add projects.

If you’re interested in investing in real estate but unsure you want to own physical property, consider starting with fractionalized commercial real estate investments with Trustcapital-realestate .