Trustcapital-realestate

The Ultimate Guide to Investing in Tokenized Real Estate

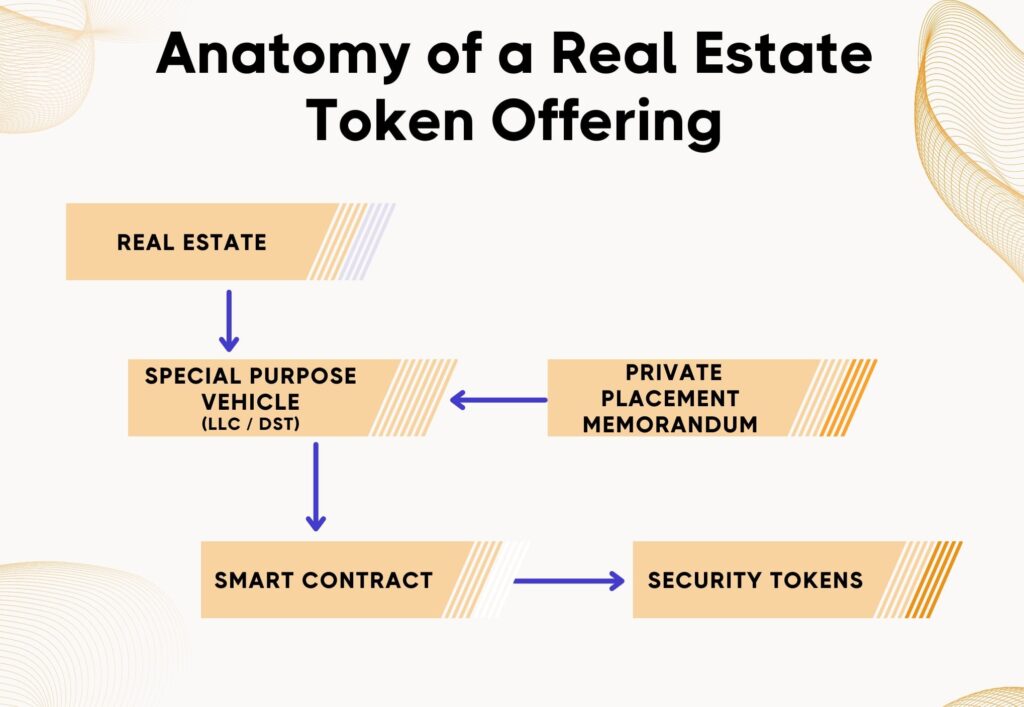

Both traditional and tokenized real estate offerings use special purpose investment vehicles (SPVs), usually structured as limited liability companies (LLCs), to invest in real estate.

Because the offering is a security, it is usually registered under an exemption from the detailed and expensive process of creating a public security.

One requirement of obtaining the exemption is that a private placement offering (PPM) is created that details what the investment is, all the potential risks of the investment, the sponsors of the investment and other relevant information. There is also a subscription agreement and an operating agreement for the SPV that specifies the investors’ rights and obligations as well as those of the managers.

Real estate security tokens are programmed by underlying smart contracts to ensure compliance with securities laws. Smart contracts can automatically enforce applicable purchase and sale restrictions as mandated by securities regulators around the world. Holding times for tokens and restrictions on who can purchase them can also be mandated using smart contracts.

To enforce these regulations, tokenization platforms perform know your customer (KYC) and anti-money laundering (AML) checks, as well as checks for investor accreditation. These checks result in particular buyers being ‘whitelisted’ or pre-approved to purchase.

How do Security Tokens work?

Understanding how security tokens work is a key part of investing in tokenized real estate.

Who is involved in the tokenization process?

1. Real estate operators: The owner (or purchaser for new acquisitions) provides the real estate and manages it for the benefit of the investors. Known as ‘Sponsors’, they may also be responsible for raising the capital necessary to invest in real estate

2. Tokenization platforms: Real estate tokenization platforms like Trustcapital-realestate use software to issue tokens and manage both the initial token sales and secondary token exchanges. Tokenization platforms also help to manage investor communications and distributions and provide an environment for investors to find real estate offerings and sponsors to raise money

3. Investors: Real estate token investors use tokenization platforms to access investment opportunities. Investors purchase digital tokens to become part-owners of specific properties.

Why tokenize real estate assets?

Many benefits can arise from tokenizing real properties. Unlike stocks and bonds, real estate is not typically fractionalized or owned in shares. Most real estate is owned by wealthy individuals and their companies.

Individual investors have other options for owning fractions of real estate—including investing in real estate investment trusts (REITs), traditional private placements, or timeshares, or participating in crowdfunding—but each of these arrangements has its challenges. Tokenization can potentially solve many of the challenges traditionally associated with fractionalizing real estate.

A major reason to tokenize real estate is to increase the accessibility of the asset class. Several limitations have historically put real estate out of reach for many investors, and real estate tokenization can remove these limitations while conferring advantages to all parties.

Here are some of the challenges traditionally facing real estate investors and how tokenization can mitigate many of the issues:

- High entry costs: Real estate can be a very expensive investment, especially for first-time investors. The cost of buying a property can be prohibitive for many people.

- Lack of liquidity: Real estate is a relatively illiquid asset, meaning that it can be difficult to sell quickly if needed. This can be a problem if an investor needs to access their money quickly.

- High risk: Real estate is a relatively risky investment. The value of real estate can fluctuate significantly, and there is always the risk of losing money.

- Limited access: It can be difficult for individual investors to access high-quality real estate investment opportunities. This is because most real estate deals are large and require a significant amount of capital.

Tokenization is a new technology that has the potential to mitigate many of these challenges. Tokenization is the process of dividing a physical asset into digital tokens. These tokens can then be traded on a blockchain network.

There are a number of ways in which tokenization can benefit real estate investors. First, tokenization can lower the entry costs for real estate investing. This is because tokens can be fractionalized, meaning that they can be bought and sold in small denominations. This makes it possible for even small investors to participate in real estate deals.

Second, tokenization can increase the liquidity of real estate investments. This is because tokens can be traded on a blockchain network, which is a 24/7/365 marketplace. This makes it possible for investors to buy and sell tokens quickly and easily, even if they need to access their money quickly.

Third, tokenization can reduce the risk of real estate investments. This is because tokens can be backed by real-world assets. This means that if the value of the underlying asset decreases, the value of the token will also decrease. However, the token will never be worth less than the underlying asset.

Finally, tokenization can increase the accessibility of real estate investment opportunities. This is because tokens can be traded on a blockchain network, which is a global marketplace. This makes it possible for investors from all over the world to participate in real estate deals.

Overall, tokenization has the potential to revolutionize the real estate investment market. By lowering the entry costs, increasing liquidity, reducing risk, and increasing accessibility, tokenization can make real estate investing more attractive to a wider range of investors.

Here are some specific examples of how tokenization is being used in the real estate market:

- Propy: Propy is a real estate platform that uses blockchain technology to facilitate the buying and selling of properties. Propy tokens can be used to purchase real estate, and they are backed by the underlying property.

- Fundrise: Fundrise is a real estate investment platform that allows investors to invest in real estate through a variety of different funds. Fundrise tokens can be used to purchase shares in these funds, and they are backed by the underlying real estate assets.

- Brickblock: Brickblock is a real estate investment platform that allows investors to invest in real estate through a variety of different projects. Brickblock tokens can be used to purchase shares in these projects, and they are backed by the underlying real estate assets.

These are just a few examples of how tokenization is being used in the real estate market. As the technology continues to develop, we can expect to see even more innovative ways to use tokenization to make real estate investing more accessible and efficient and Trustcapital-realestate will be there to leverage the opportunity.